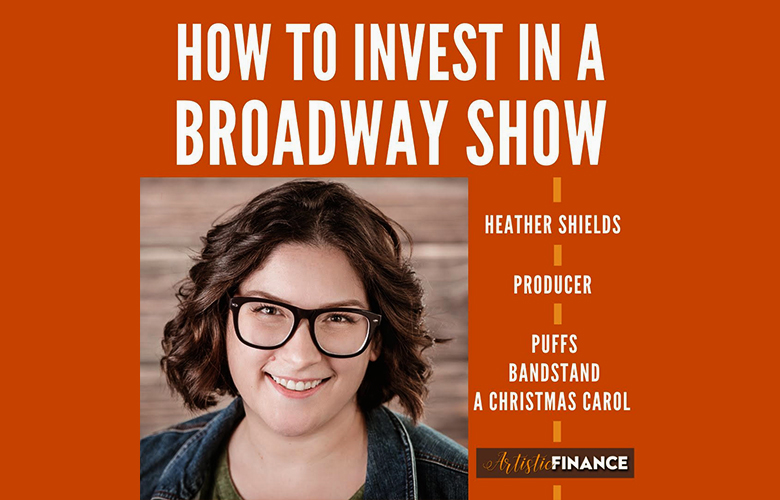

Broadway producer Heather Shields explains how to invest in a Broadway show. Heather has produced Broadway’s A Christmas Carol, Bandstand, and the seven year off-Broadway run of Puffs: The Harry Potter Parody. She explains the ins and outs during a two part interview with Ethan Steimel on the Artistic Finance podcast.

The first half of the interview includes recoupment schedules and break even points, the forty year exploitation period of an author’s work, and detailing that investing earlier is riskier but can provide a higher return. The discussion also covers the three types of Broadway producers (lead, executive, and co) and the importance of the ten days before Christmas for seasonal shows.

The recoupment schedule is one of the most important financial documents for investors to review. It explains how many tickets need to be sold and over what time period, until the original money is recouped. Specifically, the breakeven point is what to look for. From a numbers perspective, that’s where you’ll get the best idea of the likely-hood the show could be one of the 20% that do turn a profit.

H️eather brought up something that is specific to live events versus movies or literature. That is the 40 year exploitation period of an author’s work. This matters to investors, because even if a show is a dud, it has 40 years to revive or license the work which can sometimes result in investors being repaid and even profit, many years after the Broadway financial failure.

️Investing early is riskier but can provide a higher return. You may get access to 1 for 1 or 1 for 4 which is a point system that kicks back additional money to preBroadway investors. It only matters if the show makes it past recoupment and into profit. But then, it is quite helpful.

Ethan mentioned that often when he receives investment opportunities or co-producing opportunities, they come very close to the opening of the show, or the funding deadline. Before talking to Heather, he assumed that was a bad sign because maybe the last minute financing meant the show was cash-strapped. But, that’s not necessarily true. Knowing investors receive the most favored nations contract allows Ethan to be less wary. Investors coming in at the 11th hour, who may have the advantage of seeing the show doing well in previews, get the same financial deal as someone who invested years before the Broadway run.

The Lead producers are the ones making the calls. The executive is a day to day hired producer. The co-producers are the ones connecting investors to the lead producers. This is very specific to Broadway and is not the same as TV or films.

Heather was a lead producer on A Christmas Carol, which won five Tony Awards. COVID brought its plans to a halt. Heather pointed out the importance of the ten days before Christmas for seasonal shows. In 2021, A Christmas Carol had two west coast tours that both shut due to the Omicron strain. Those shutdowns came during those ten profitable days and resulted in a loss for both productions.

The second half of the interview covered measuring revenue by gross potential, how to access opportunities to invest, and the minimum investing unit for a Broadway show. Heather also delved into the details that Broadway investors must be accredited, almost always file an extension for taxes, and the documents investors sign included an operating agreement, subscription agreement, and W9.

If you reach a dead end, you can always email Heather or Ethan (at artisticfinancepodcast@gmail.

Ethan vowed to remember that the next time he looks at Broadway grosses–something he included in the Artistic Finance newsletter. The Lion

A minimum investing unit for a Broadway show is usually $25,000-$50,000. Every investor must be accredited. Accredited means having a net worth of $1,000,000 (not including a primary residence) or making $200,000 a year for two years running with reasonable expectation of making it for a third year. That jumps to $300,000 a year for partners filing jointly. And the reason Broadway investors must file extensions on their taxes is because the accountants on Broadway don’t get to completing Broadway K1s until April 15th or later.

Ethan mentioned that the accredited investor bar is high. That limits theatre workers from investing in their own shows. Heather admits it is gatekeeping but helps producers. When shows lose their money, the investors were accredited which means they didn’t put in money that they couldn’t afford to lose. While it stings, it isn’t affecting anyone’s livelihood. Heather mentioned The Industry Standard Group and The Producer’s Hub are working to find ways for producing work without the accredited investor hurdle. Their missions are to enable storytelling from historically marginalized communities, hence the importance of overcoming the accredited investor hurdle.

Watch the full interview here.

Heather is an award-winning producer and theatre manager. She made her Broadway producing debut in 2017 with the Tony Award-winning Bandstand and was most recently a lead producer on A Christmas Carol. She is also a producer on the Off-Broadway hit Puffs! Heather serves as the General Manager of the long-running, downtown sensation BATSU! NYC and opened BATSU! Chicago to critical acclaim in 2016. She co-founded The Business of Broadway in 2019. Heather lives in Queens with her husband and daughter, Clara.

Artistic Finance is a podcast hosted by Ethan Steimel. Each week he interviews a professional in the entertainment industry to answer common financial questions and provide a resource for artists to have their money questions answered.

Lighting Up The Dance Floor with Lighting Designer Marsha Stern

Ethan has designed lights for Masters of Illusion--Live! (US/Canada Tour), La Bohéme (El Paso Opera), The Baker’s Wife (Theatre Row). As a lighting director he has worked at CNN, Bloomberg, and Broadway HD. He is a co-producer of Broadway's A Christmas Carol and hosts Artistic Finance, a weekly podcast about finance for artists.

Read Full Profile© 2021 TheatreArtLife. All rights reserved.

Thank you so much for reading, but you have now reached your free article limit for this month.

Our contributors are currently writing more articles for you to enjoy.

To keep reading, all you have to do is become a subscriber and then you can read unlimited articles anytime.

Your investment will help us continue to ignite connections across the globe in live entertainment and build this community for industry professionals.