Wherein a former bank president finds herself running a performing arts company one month before the pandemic hits. What does she learn from the experience and how does she put the organization on the path to sustainability?

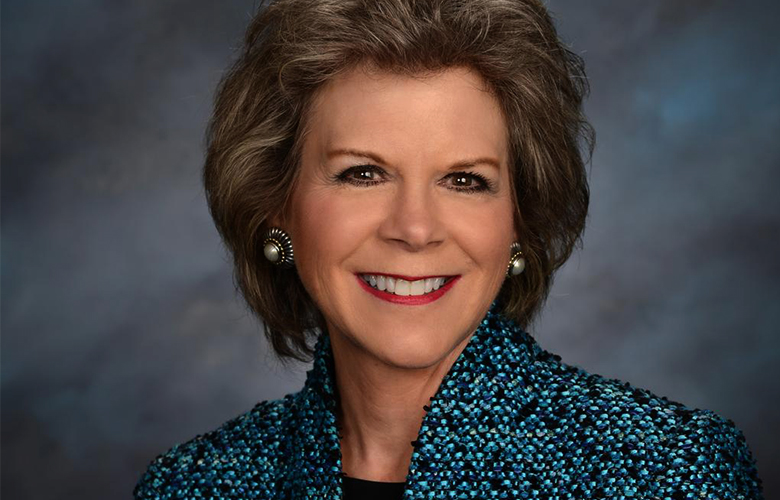

Pat McDonald retired from a distinguished 35-year career in financial services and banking in Dayton, Ohio. After a brief period, she found herself running the Dayton Performing Arts Alliance – two months before the pandemic lockdowns started. We talked to her about strategy, communications, and sustainability – and how she brought a for-profit business perspective to the challenge of running a not-for-profit during the pandemic.

I live in Dayton, Ohio, with my husband David. I retired as Dayton Market President for Key Bank in 2017. I worked in commercial banking, wealth management, and retail banking for almost 35 years. I was on several not-for-profit boards and was the chair of the Greater Dayton Chamber of Commerce and I had a lot of energy to give back to the community!

Within a noticeably short time after announcing my retirement, I found myself filling an interim gap as President and CEO of the Boonshoft Museum of Discovery in Dayton. I was there for about six months during which time I helped hire a new CEO and generally made sure that the organization was moving forward in an organized and strategic way – I’m big on strategy. After leaving the Boonshoft, in 2019, I had some down time for about a year until the Board Chair of the Dayton Performing Arts Alliance – a grouping of the Dayton Philharmonic, Dayton Ballet, and Dayton Opera – came calling. Again, they wanted me to fill in a gap between CEO’s. They said: “90 days, maybe six months top!” This was February of 2020 – about 30 days before the COVID -19 Pandemic forced Ohio, and the rest of the world to close just about everything – including all performing arts venues.

It was really a case of being well known in the community and being available.

The Boonshoft came about because a former employee of mine at Key Bank was on the Board, and we had had many conversations over the years about her challenges as a trustee. At the DPAA, I was on the Board before joining the Boonshoft and was in line to be deputy Board chair when the call came. Again – I was well known to the organization, and I had time on my hands, some management skills, and the energy to get involved.

I started at the DPAA on February 2nd, 2020 – 30 days before the shut-down and I’m finishing up in August of 2021, so about 18 months total.

The transition from trustee to CEO was really like “night and day.” Moving from a governance role as a board member to the overall executive management of a unique grouping of arts organizations was – not to be too theatrical – dramatic! My mandate from the Chair of the Board and the Executive Committee was firstly to keep the organization moving forward – making sure that the concerts happened, that planning for the 20/21 Season continued, and that we were also getting ready for the public launch of endowment campaign to raise significant and much needed funding. And I would be helping with the search for the new president and CEO.

There was also a bigger initiative that the Board had begun before I arrived. For many years the financial performance of the organization pointed to a lack of sustainability. Excessive investment draws, and operating deficits suggested that a new operating model based on a dictum of funding programming with existing and realistic revenues needed to be instituted. Also, the organizational culture was largely siloed with little communication between the three operating entities and senior staff. There was some heavy lifting in both these areas, but I had managed large teams and worked with companies in difficult financial shape in my banking career – so, I was “all in.” And then the Pandemic landed, and everything changed.

Well, although we joked about it between staff and board many times, the reality of the situation was no, I was there to do a job and while a lot of the job had changed overnight, there were still a lot of things that needed to be accomplished.

Understanding that initially we expected this pandemic closure to last maybe 4 to 6 months, the first thing was to get people focused on what needed to be done and who was going to do it. We instituted a mandatory senior leadership Zoom call every day that focused on individual priorities of each department including the artistic disciplines, and the support areas such as finance, marketing, operations, fundraising, and education. We just went around the “Zoom” asking the same questions every day: What do you need to accomplish, what programs need to be postponed or cancelled, what do we do with staffing, cash flow, etc. Within a month, we had a document that summarized all our activities and who was responsible for what within the organization: that became our COVID – 19 guide.

Another priority that I undertook was to contact all our major stakeholders. Because of my profile in the community and a certain amount of credibility that I had built up over many years, I was able to call just about anyone and ask for help – which of course really means asking for money. I was well known in financial circles with major donors, corporations, and foundations and I had personal relationships with most of these folks either through my banking background or other organizations I was involved in.

There was a healthy element of skepticism in these conversations with donors and supporters, but I had the commitment of the board that they would support significant operational change that would lead to sustainability. I felt that with a rational plan in place, and open and transparent communication with our stakeholders, we would bring about a new confidence in the community about our direction.

Ultimately, people proved to be incredibly generous.

I would rather say that it was my “business brain” that was kicking in. As a banker, I knew what went into a successful business and what was missing when organizations – for-profit and not-for-profit – got into trouble. A basic system that stressed financial discipline was essential so, our dictum became: “If it can’t be funded, it can’t happen.” The DPAA needed to improve its internal communications, so we worked on having regular meetings with agendas and outcomes. As I said earlier, we started off with Zoom meetings daily and through the course of the year we were able to reduce those numbers gradually to where we only meet once a week as a senior team. I also put into place some basic sales management tools so that when we would go to a major donor to ask for funds we had a plan, we had done significant research on the prospect, and we knew who was going to ask what in the meeting.

With a very broad spectrum of unionized, non-union, contractors, full time and part time staff, and others, and a need to minimize the expenses relating to salaries wherever possible, the only strategy we arrived at was to deal with each group individually and to try and be fair and as transparent as possible. This was easier with some groups than with others. The needs and wants of a unionized musician are far different than a part time marketing assistant or a contract dancer. Some groups were understanding, and others took significantly more time to convince that the organization was facing perhaps the greatest financial challenge in its history. In the end, not everyone was happy with the outcomes, but I believe that we were able to make our case in a satisfactory manner.

One of the benefits of managing the workforce in this situation is that we were able to really look at our organizational chart and say – “What do we really need here?”

We had a blank slate and we have been able to redefine our organizational needs and realign our workforce.

I knew that ramping up the level of communication with the Board members was going to be essential for raising funds and steering our way through the various conflicts we would face in this challenging period. I started by striking an ad-hoc committee made up of the Emeritus Chair, the current Chair, the Vice Chair, and the Board Treasurer. I said we would meet a couple of times a month for the foreseeable future, and sometimes we met weekly. They were an invaluable resource and sounding board for me and our CFO as we navigated through the pandemic. I also increased the frequency of meetings with the Finance committee from monthly to weekly. This was extremely helpful in getting feedback on our operating and financial planning. We also created what I would call, a mini strategic plan for the trustees that would follow us through the next couple of years. We presented this at the Annual meeting where we asked for – and received the backing of the Board.

Again, it goes to communication. We planned regular meetings with our landlord and had a lot of ad-hoc discussions as things would arise that we hadn’t thought of or planned. I had a good working relationship with our landlord at Dayton Live as did our CFO and theirs. There was and continues to be an initiative to look at shared cost savings and simplification – an example is that we have two separate collective agreements with the stagehands union and Dayton Live has their contract. We looked for ways of consolidating those agreements that would save us some money or just make life simpler.

There were times when we did have to say NO, we can’t do that unless there is funding. And, yet there were also some programs that we felt strongly about that we knew we were going to have trouble funding.

My response was always: “Let’s do that program, but where can we take some funds from somewhere else to make up the difference?” When we engaged the artistic directors around the integral elements of our mission statement, they responded by helping to fundraise in the community. And the message that things were going to be different not only in the short term but, in the long term really started to take hold.

I would say that the biggest outcome is that we had the opportunity to start over in terms of the way we do business as a performing arts company. There is, I think a much better understanding of the “business” that we are in and how we can be a more sustainable organization. We are downsizing our programming next year – from 72 to 54 performances, and those performances and programs will all have a funding strategy to ensure that they are viable. There will be some new job titles as we have sought to make sure that our needs in this new world are matched by the talents of our staff. We are going to have to continue to make some hard decisions around the financing of this organization and ensure that we maintain the fiscal discipline that we have had to live by for the last 16 months. One of the first pieces of business for the new President and CEO will be to start a strategic planning process that continues with some of the strategies undertaken during the pandemic that point the way to sustainability.

Well, sometimes working in corporate America is not the most creative endeavor but working at the Dayton Performing Arts Alliance has, for me been a very creative experience. It has been so rewarding watching people adapt and come to new realizations about their work process, and how to approach the operation of their organization from the perspective of ensuring artistic excellence, but also ensuring fiscal and ultimately organizational sustainability.

I suppose that on the face of it, none of this is “rocket science.” Still, I continue to see organizations presenting unrealistic operating budgets to their boards, having mediocre management practices, and developing poor communication strategies. I’m a pragmatic manager who understands that no matter how wonderful a program might be, and how rooted it might be to your mission and vision, if you can’t find funding for it then maybe you should think of a different program. That’s a message that certainly isn’t tied to the pandemic – it’s how people should be thinking on a day-to-day basis. If you aren’t thinking about organizational sustainability, you aren’t really planning for a strong organization in the future.

While I have really enjoyed my last 18 months at the DPAA, and there was some pressure exerted on me to consider applying for the President and CEO job, I know that that is not the job for me. My mandate in both my not-for-profit postings has been to transition, stabilize, and steward. I’m not the right person to take the organization to the next level. That requires a level of commitment that I’m not equipped to give. But I am positive that I’m not finished contributing to the community – in whatever way that presents itself. After all, my business card says: “CEO FOR RENT.”

Ken Neufeld is a retired arts executive who lives on Vancouver Island. He is the originator of the 2 Minute Arts Manager. Pat McDonald served as his Board Chair at the Victoria Theatre Association in Dayton, OH from 2009 -2011.

Backwards Planning: Yes! It’s a Thing

Summer Programming for Arts Organizations

Ken Neufeld is a visionary not for profit executive with senior leadership experience at major arts and cultural organizations in both Canada and the United States. Most recently, Mr. Neufeld was president and CEO at Victoria Theatre Association – a 5 theatre performing arts center attracting over 500,000 patrons annually in Dayton, Ohio. While in Dayton, he conceived and raised the funds for the new PNC Arts Annex, raised $15 million allocated to current use projects and the organization’s endowment, and realized an operational surplus on an over $16 million budget in 8 out of 9 seasons. In addition to the overall responsibilities of running the Association, Mr. Neufeld also oversaw a major parking operation, a full-service restaurant and catering company, a ticketing operation, and the management of the largest group of non-governmental real estate holdings in downtown Dayton. Mr. Neufeld has also served as the Executive Director of a LORT B producing theatre for almost nine years, the Producer and GM at a ground-breaking performing arts center in Canada that initiated a series of innovative programs with a rapidly expanding Asian population, at a Civic Museum and Planetarium complex, and as the revenue manager for a prominent Canadian regional theatre company. He has an MA in Theatre from Michigan State University, a BA in Theatre from the University of Winnipeg, and continuing education certificates from educational organizations including Harvard Business School, Ross Business School at the University of Michigan, and the Banff Center. Ken was selected to participate in the inaugural pilot group of National Arts Strategies CEO program and then completed the program in 2012. He served as a Tony Awards voter for 9 years. He is the originator of The 2 Minute Arts Manager, a weekly video blog appearing on YouTube, LinkedIn and Facebook. He lives in Nanaimo, British Columbia.

Read Full Profile© 2021 TheatreArtLife. All rights reserved.

Thank you so much for reading, but you have now reached your free article limit for this month.

Our contributors are currently writing more articles for you to enjoy.

To keep reading, all you have to do is become a subscriber and then you can read unlimited articles anytime.

Your investment will help us continue to ignite connections across the globe in live entertainment and build this community for industry professionals.